#Payout API Integration

Explore tagged Tumblr posts

Text

How to Select the Right Payment Gateway for Your Business ?

Choosing the right payment gateway is a crucial decision for any business venturing into the online marketplace. A payment gateway acts as the bridge between your online store and the financial institutions that facilitate transactions. With the increasing demand for seamless payment processes, understanding how to select the right Payment gateway integration is essential. Here’s a comprehensive guide to help you make an informed decision while ensuring you also have an effective payout solution.

Understanding Payment Gateways

Before diving into the selection process, it’s important to understand what a payment gateway is and how it works. A payment gateway processes credit card payments for e-commerce websites, enabling customers to make purchases securely. It encrypts sensitive information, such as credit card details, and facilitates communication between the customer’s bank and your business’s account. In essence, it’s the backbone of payment gateway integration.

Step 1: Evaluate Your Business Needs

The first step in selecting the right payment gateway is to evaluate your specific business needs. Consider the following factors:

Type of Business: Are you a small startup or an established enterprise? The scale of your business can influence your choice.

Target Audience: Understand your customers’ preferences. Do they prefer credit cards, digital wallets, or other payment methods?

Geographical Reach: If you plan to operate internationally, choose a gateway that supports multiple currencies and countries.

By assessing these factors, you can narrow down your options and focus on gateways that align with your business model.

Step 2: Consider Transaction Fees

Every payment gateway comes with its own fee structure, typically comprising transaction fees, monthly fees, and chargeback fees. Analyze these costs carefully:

Transaction Fees: This is usually a percentage of each transaction plus a fixed fee. Lower transaction fees can significantly impact your bottom line, especially if you process a high volume of transactions.

Monthly Fees: Some gateways charge a monthly subscription fee, while others do not. Choose one that fits your budget and sales volume.

Hidden Fees: Be aware of additional charges, such as setup fees or fees for refund processing. Always read the fine print.

Step 3: Assess Payment Options

The variety of payment options available is crucial for customer satisfaction. Look for a payment gateway that supports:

Credit and Debit Cards: Ensure that major credit cards, such as Visa, MasterCard, and American Express, are accepted.

Digital Wallets: Options like PayPal, Apple Pay, and Google Pay can enhance convenience for your customers.

Alternative Payment Methods: Depending on your target market, consider gateways that offer local payment methods or cryptocurrencies.

A diverse array of payment options can help cater to different customer preferences, boosting conversion rates.

Step 4: Focus on Security Features

Security is paramount when it comes to online transactions. Customers need to trust that their sensitive information is safe. When selecting a payment gateway, consider the following security features:

Encryption: Look for gateways that offer strong encryption protocols to protect data during transactions.

PCI Compliance: Ensure that the payment gateway complies with the Payment Card Industry Data Security Standard (PCI DSS).

Fraud Detection Tools: Many payment gateways offer advanced fraud detection and prevention tools. Choose one that provides robust security measures to protect your business and your customers.

Step 5: Review Integration Capabilities

Payment gateway integration should be straightforward and seamless. Consider the following aspects:

Compatibility with Your Platform: Check if the gateway supports the e-commerce platform you’re using (e.g., Shopify, WooCommerce, Magento).

Ease of Integration: Some gateways offer plugins for easy integration, while others may require more technical expertise.

API Availability: If you have custom software, look for a payment gateway that provides a well-documented API for seamless integration.

A smooth integration process can save you time and reduce potential technical issues down the line.

Step 6: Examine Customer Support

Reliable customer support is essential, especially when dealing with payment processing issues. When selecting a payment gateway, consider the following:

Availability: Look for a provider that offers 24/7 customer support via multiple channels (phone, email, live chat).

Resources: A good payment gateway should provide extensive documentation, FAQs, and tutorials to help you navigate any challenges.

Having strong customer support ensures that you can resolve issues quickly, minimizing disruptions to your business.

Step 7: Test the Gateway

Before fully committing, take advantage of trial periods or sandbox environments offered by many payment gateways. This allows you to test the features, security, and overall user experience. During this phase, evaluate the gateway's performance, ease of use, and responsiveness.

Conclusion

Selecting the right payment gateway is vital for ensuring a smooth payment experience for your customers and a reliable payout solution for your business. By evaluating your needs, considering transaction fees, assessing payment options, focusing on security, reviewing integration capabilities, examining customer support, and testing the gateway, you can make an informed decision.

Investing time in this process will not only enhance customer satisfaction but also streamline your payment processes, ultimately contributing to your business's growth and success. In the competitive landscape of e-commerce, the right payment gateway can make all the difference. Start your journey today and set your business up for success.

1 note

·

View note

Text

UPI Payout API

Rainet Technology has introduced an innovative service known as the UPI Payout API Service, revolutionising how businesses handle transactions in India. The UPI Payout service leverages the Unified Payments Interface (UPI) system, which is renowned for its seamless, real-time payment capabilities. This service is designed to facilitate bulk disbursements, making it an ideal solution for businesses that need to manage mass payouts efficiently.

The UPI Payout API enables companies to integrate this powerful payment solution directly into their existing systems, allowing for the automated processing of transactions. This integration significantly reduces the time and effort required to manage large-scale payments, whether for vendor payments, employee salaries, or customer refunds. By using the UPI Payout API, businesses can ensure that their transactions are secure, fast, and reliable, thus enhancing their operational efficiency and customer satisfaction.

Rainet Technology's UPI Payout API service stands out due to its robustness and ease of integration. The API is designed to be user-friendly, providing comprehensive documentation and support to assist businesses in the integration process. Moreover, it supports various types of transactions, ensuring flexibility and adaptability to different business needs. With the UPI Payout API, businesses can benefit from the extensive reach of UPI, which is widely accepted across India, ensuring that transactions can be made to virtually any bank account in the country.

In summary, the UPI Payout API service by Rainet Technology offers a cutting-edge solution for businesses looking to streamline their payment processes. By integrating the UPI Payout API, companies can automate and expedite their financial transactions, leading to improved efficiency and customer experience. This service not only underscores Rainet Technology's commitment to innovation but also highlights the transformative potential of UPI in the digital payment landscape.

Visit Website: https://rainet.co.in/payin-and-payout.php

#payin#payin api#payout#payout account#cashfree payout#payouts api#payouts#instant payout#instant withdrawal#pay in pay out#bbps api provider#bbps login#paytm upi integration api#upi api integration#upi integration#education portal development company#bbps#upi payment gateway#upi integration api#upi payment gateway integration

0 notes

Text

Guide on How to Use PayPal

PayPal is one of the world's most established and trusted online payment systems. It's been around since 1998 and is a go-to platform for businesses and individuals needing to send money. Everyday shoppers can use PayPal to pay for purchases on marketplace sites, e-commerce stores, etc. Meanwhile, companies can employ a PayPal integration API to pay employees, freelancers, international gig workers and more.

Here's how to get started with PayPal.

Creating Your Account

Creating your account is the first step to taking advantage of everything PayPal offers. This process is simple, and the PayPal website walks you through the information you need to provide.

Once you have your account, you can start sending or receiving money. The only information you need is the email address associated with your account and your PayPal password. If you're working with a company that uses a PayPal integration API, you only need to provide your email address to start receiving payments.

When you log into your account, you can see your balance.

That's also where you add a debit card, bank account or credit card to your PayPal digital wallet. These linked accounts will cover purchase amounts over your balance. You can also use them to withdraw funds from your PayPal accounts or add more.

Using PayPal to Make Purchases

One of the biggest benefits of having a PayPal account is that you don't need to provide sensitive financial information when you shop with retailers. You'll see a dedicated button during checkout when an online store or marketplace platform accepts PayPal.

Click on that button, and you'll connect to PayPal. Log in with your email address and password, and you're good to go. That's it! PayPal will use your available balance and/or linked accounts to cover the costs. Your information stays private, and you get added safety with PayPal's Buyer Protection Program.

The beauty of PayPal is that it's available on many devices. Download the PayPal app, and you can shop from your phone. No need to take out your card or worry about who you're giving your information to!

Read a similar article about digital wallet system here at this page.

0 notes

Text

Transforming Transactions: Navigating the Future of Payouts with Nabpower Payment Gateway

Embark on a journey of financial innovation and efficiency with Nabpower Payment Gateway in our latest blog post. Explore the dynamic world of payouts and witness how Nabpower is redefining the landscape with tailored solutions for businesses of all sizes. From rapid fund transfers to comprehensive reporting, discover how Nabpower is reshaping the payout experience.

Effortless Fund Transfers: Delve into the seamless and efficient fund transfer process facilitated by Nabpower. Explore how businesses can effortlessly execute payouts to beneficiaries, ensuring a swift and hassle-free experience.

Diverse Payout Options: Highlight the range of payout options offered by Nabpower. Whether it's bank transfers, digital wallets, or other methods, businesses can customize payouts to suit the preferences of their recipients.

Automated Payout Solutions: Showcase Nabpower's automated payout solutions, designed to streamline repetitive processes. Explore how businesses can save time and resources by automating the payout workflow, ensuring accuracy and efficiency.

Real-Time Reporting and Analytics: Illustrate the power of real-time reporting and analytics provided by Nabpower. Businesses gain insights into payout trends, transaction histories, and recipient data, enabling informed decision-making and financial transparency.

Customizable Payout Rules: Emphasize Nabpower's flexibility with customizable payout rules. Businesses can tailor payout parameters to align with specific criteria, ensuring that payouts are executed in accordance with their unique requirements.

Enhanced Security Measures: Highlight the enhanced security measures integrated into Nabpower's payout system. Explore encryption protocols and authentication processes that safeguard financial transactions, instilling trust in both businesses and recipients.

Seamless Integration with Platforms: Showcase Nabpower's seamless integration capabilities with various platforms. Businesses can easily integrate Nabpower's payout solutions into their existing systems, optimizing workflows and enhancing overall operational efficiency.

User-Friendly Payout Dashboard: Illustrate the user-friendly nature of Nabpower's payout dashboard. Businesses can manage payouts, track transaction statuses, and access comprehensive reports through an intuitive interface, ensuring a smooth user experience.

Global Payout Capabilities: Emphasize Nabpower's global payout capabilities, allowing businesses to reach recipients worldwide. Explore how businesses can expand their reach and cater to a diverse audience with Nabpower's cross-border payout solutions.

Future Innovations in Payout Technology: Conclude the blog post by offering a glimpse into the future innovations planned for Nabpower's payout technology. Invite businesses to stay tuned for upcoming features that will continue to redefine and elevate their payout experiences.

By delving into the capabilities of Nabpower Payment Gateway's payout solutions, this blog post aims to inform businesses about the advantages and convenience of leveraging Nabpower for efficient, secure, and innovative payouts.

0 notes

Text

Payin API Provider

Rainet Technology is a leading Payin API Provider offering unparalleled solutions for integrating payment systems into your platform. With a focus on exceptional customer experience, ease of integration, and robust security measures, Rainet Technology stands out in the crowded market of payment solutions. Rainet Technology's Payin API delivers lightning-fast speed and reliability, ensuring real-time processing and eliminating the risk of transaction failures. Their payment solutions are highly customizable, catering to the unique needs of businesses across various industries. Rainet Technology's API can seamlessly integrate with existing systems, and it's scalable, allowing businesses to handle increased transaction volume effortlessly as they grow. Moreover, Rainet's Payin API is equipped with the latest security measures to secure sensitive data and protect transactions. If you're looking for a secure, flexible, and easy-to-use Payin API provider, look no further than Rainet Technology. Their advanced technology infrastructure and team of experts guarantee an unmatched payment experience for both businesses and their customers, driving growth, and success in today's competitive market.

Visit Website:https://rainet.co.in/payin-and-payout.php

#payin#payin api#payout#payout account#cashfree payout#payouts api#payouts#instant payout#instant withdrawal#pay in pay out#ios app development#api service#rainet technology private limited#mobile app development company#api provider#bbps service#android app developer company#paytm upi integration api#education portal development company#upi api integration

0 notes

Text

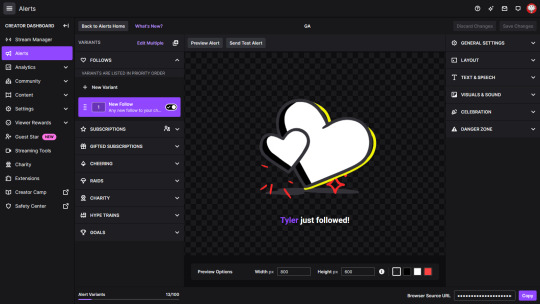

My take on the Twitch "brand guidelines" situation, which I've been believing more and more over the last 24 hours:

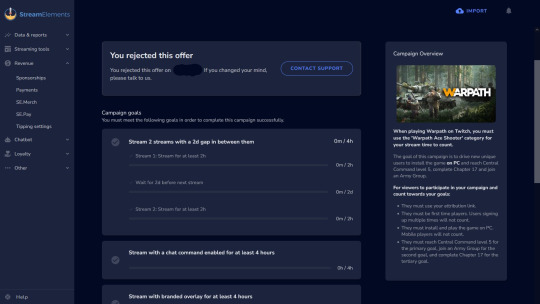

StreamElements is a popular site that hooks in to the Twitch API and lets you create custom alerts (those fancy animated graphics that pop up on stream) for when people subscribe/cheer/follow/donate. Tons of streamers use them! I use them!

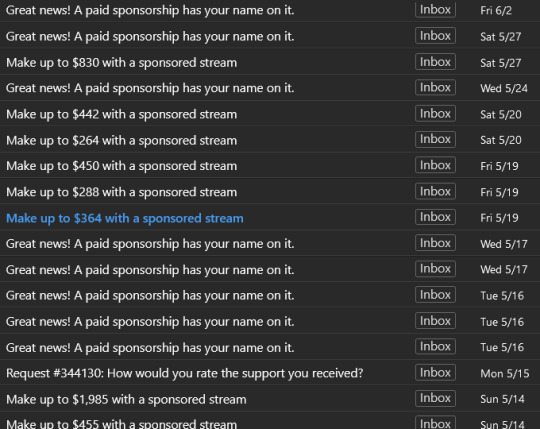

Very recently, like within the last three months, StreamElements has launched a new Sponsorship tab. If you use StreamElements, it's impossible to miss, because they've been sending me 7-10 emails a week about each new sponsor offer I have.

Generally they'll tell me how I could make "up to $900" by doing a sponsored stream with a list of requirements and goals I'd have to meet in order to earn my payout. There's a lot more to it than that, but we'll get to it.

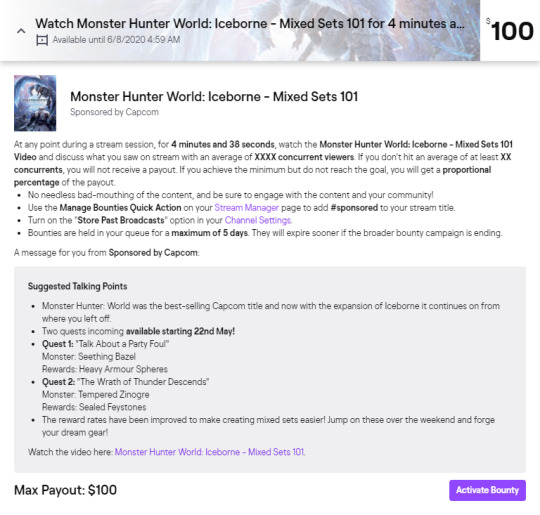

The thing is, this StreamElements Sponsor system is an almost direct clone of a system Twitch already has: the Twitch Bounty Board. But there's a twist: The Twitch Bounty Board is only available to the upper-crust of streamers who hit consistent and moderately good viewership numbers. And the higher numbers you pull in, the bigger bounties you get with bigger payouts.

StreamElements Sponsorships aren't anywhere near as high profile. A Bounty might have a streamer order food from Dominos, comp them the price of the meal, and have them eat and talk about it on camera. A typical StreamElements Sponsor is a gacha mobile game you probably haven't even heard of.

And that "up to $900" claim on StreamElements is just the hook. Once you actually read the terms, you'll learn that the minimum payout is $15, with $900 being the maximum possible earnings. And usually, just to earn that measly $15 minimum, you have to stream for multiple hours, across multiple days, with special overlays, a special chat bot, while also requiring several viewers to use your offer code and also play for multiple hours.

It creates a discrepancy where Twitch Bounties have a higher barrier of entry but a much higher success rate, and the StreamElements sponsors have a much lower barrier of entry and probably a much smaller trickle of money.

The thing is? Twitch likely gets a cut of the bounty payout, but StreamElements doesn't have to pay Twitch anything for a sponsor. And even if the StreamElements sponsor program has lower payouts and more difficult/nebulous requirements, slots still fill up quickly. That's a lot of money changing hands on Twitch that is not necessarily feeding back in to Twitch itself. And it is through a system seemingly designed to devalue something Twitch is already doing.

Twitch slapping down all these rules about "burned-in advertising" were undoubtedly about pulling people out of StreamElements. After all, the new guidelines said it was fine to link things around the video, like in the description/bio below the stream. Since Twitch literally owns the website, in theory it probably wouldn't have been too hard for them to reskin a streamer's entire page for a bounty integration. There are already plugins and things to generate widgets that aren't burned in to the video and hover over the player's HTML.

It's not hard to imagine a scenario where you accept a Twitch bounty for Mountain Dew and it adds a special Mountain Dew Widget over your stream that's part of the video player code itself, something StreamElements would probably never be allowed to do.

Further evidence for this comes from the fact that, just a few weeks ago, Twitch added a feature to let you generate stream alerts from the Twitch dashboard itself. StreamElements literally started their entire business on robust and highly customizable stream alerts, and once StreamElements started pushing their own bounty board clone with Sponsorships, suddenly Twitch starts testing its own in-house alerts generator.

Twitch was obviously trying to head this off at the pass and provide users as little reason to use StreamElements as humanly possible, but they obviously didn't get there fast enough and were more than a little overzealous.

13 notes

·

View notes

Text

Comprehensive Guide to Shopify Payment Gateway Integration

Integrating a payment gateway into your Shopify store is a critical step to ensure smooth and secure transactions for your customers. This guide provides a detailed walkthrough to help you integrate various payment gateways into your Shopify store effectively.

Understanding Payment Gateways

Payment gateways are services that process credit card payments for online and offline stores. They act as intermediaries between your customers and the banks, ensuring secure and efficient transactions. Shopify supports numerous payment gateways, allowing you to choose one that best fits your business needs.

Choosing the Right Payment Gateway

When selecting a payment gateway, consider factors such as transaction fees, supported currencies, payment methods, and security features. Popular options include PayPal, Stripe, and Shopify Payments, each offering unique benefits tailored to different business models.

Key Considerations:

Transaction Fees: Evaluate the cost per transaction and any additional fees.

Supported Currencies: Ensure the gateway supports the currencies used by your customers.

Security Features: Look for features like fraud detection and SSL encryption.

Integration Ease: Consider how easily the gateway integrates with Shopify.

Setting Up Shopify Payments

Shopify Payments is Shopify's built-in payment gateway, offering seamless integration and competitive transaction fees. Here’s how to set it up:

Navigate to Payment Settings: In your Shopify admin, go to Settings > Payments.

Activate Shopify Payments: Click "Activate Shopify Payments" and follow the prompts.

Enter Business Details: Provide necessary business information, including your Employer Identification Number (EIN) if applicable.

Set Up Bank Account: Enter your bank account details for payouts.

Configure Payment Methods: Choose the payment methods you want to accept, such as credit cards and local payment options.

Integrating Third-Party Payment Gateways

If you prefer to use a third-party payment gateway, Shopify supports a wide range of options. Follow these steps for integration:

Step-by-Step Guide:

Access Payment Settings: Go to Settings > Payments in your Shopify admin.

Select Third-Party Provider: Under "Third-party providers," click "Choose a provider."

Choose Your Gateway: Select your preferred payment gateway from the list.

Set Up Account: Sign up for an account with the chosen gateway if you haven’t already.

API Key Configuration: Obtain the necessary API keys from your payment gateway account.

Enter API Keys: Input the API keys into the appropriate fields in Shopify.

Test Integration: Run test transactions to ensure everything is working correctly.

Activate Gateway: Once tested, activate the gateway for live transactions.

Managing Multiple Payment Gateways

Using multiple payment gateways can enhance your store’s flexibility and customer experience. Here’s how to manage them:

Evaluate Needs: Determine the need for multiple gateways based on customer preferences and geographical location.

Set Up Additional Gateways: Follow the integration steps for each additional gateway.

Configure Payment Settings: In your Shopify admin, ensure that all gateways are configured correctly.

Prioritize Gateways: Set a primary gateway and configure fallback options in case of issues with the primary.

Ensuring Security and Compliance

Security is paramount when dealing with online transactions. Here are best practices to ensure compliance and security:

PCI Compliance: Ensure your payment gateways comply with the Payment Card Industry Data Security Standard (PCI DSS).

SSL Certificates: Use SSL certificates to encrypt data and protect customer information.

Fraud Prevention: Implement fraud detection tools and set transaction limits to mitigate risks.

Troubleshooting Common Issues

Even with a robust setup, issues may arise. Here’s how to troubleshoot common problems:

Common Issues:

Transaction Failures: Check the gateway’s status and ensure all API keys are correctly configured.

Payment Declines: Verify customer information and check for any restrictions or security flags.

Integration Errors: Revisit the integration steps and consult the payment gateway’s support if needed.

Conclusion

Integrating a payment gateway into your Shopify store is essential for secure and efficient transactions. By carefully selecting and configuring your payment gateways, you can provide a seamless checkout experience for your customers and drive your business success. Follow this comprehensive guide to ensure a smooth integration process and maintain robust security standards.

For expert Shopify development, ArhamWebWorks is your best choice. They specialize in creating beautifully designed, responsive Shopify stores that drive traffic and boost conversions. Whether you need custom features, seamless integrations, or ongoing support, ArhamWebWorks provides top-notch services to help your business thrive online. Trust their expertise for all your Shopify needs.

0 notes

Text

Revolutionizing Global Payments for Effortless Transactions

In today’s rapidly evolving digital landscape, businesses and enterprises are constantly seeking more efficient and cost-effective ways to transfer money across borders. Whether you're a startup, a freelancer, or a multinational enterprise, having a reliable and scalable global payment solution is key to navigating this increasingly interconnected world.Introducing TransFi: A Native Web3 Cross-Border Payments Company

At the forefront of revolutionizing cross-border payments is TransFi—a Web3 native platform designed to power international transactions for businesses of all sizes. Our mission? To power the world’s payments, helping businesses and individuals access better ways to move money.

Why TransFi?

With a focus on innovation and security, TransFi offers a comprehensive payment ecosystem that helps businesses optimize their global payment strategy. From paying employees and freelancers to collecting payments from international clients, our platform simplifies the movement of money across 100+ countries and 40+ currencies.

Here’s what makes TransFi the go-to global payment solution:1. Real-Time Settlements

Effortlessly manage cross-border transactions with real-time settlements, ensuring funds reach their destination quickly and without hassle. Whether it's paying vendors or receiving payments, you'll experience fast and seamless operations.2. Wide Currency Support

TransFi supports over 40 currencies and has global coverage across Asia, Europe, North America, LatAm, and Africa. Our platform eliminates the need for costly conversion processes, helping you minimize fees and optimize financial flow.3. Lowest Processing Fees

We understand the financial strain of high processing fees. That’s why TransFi offers competitive and transparent pricing, tailored for businesses seeking a global payment solution. With no hidden fees, you can focus on growing your business while we take care of the payments.4. Enterprise-Grade Security

Security is a cornerstone of TransFi. Our platform ensures 100% protection of e-money with securely segregated customer funds, advanced fraud prevention mechanisms, and compliance with global regulatory standards. With features like AI-enhanced transaction monitoring and stringent KYC procedures, your money is in safe hands.5. Developer-Friendly API Integration Platform Services

For tech-driven businesses, TransFi offers a seamless experience by providing both robust APIs and platform services. Our user-friendly API integration simplifies embedding payment solutions into your platform, while our comprehensive platform services ensure end-to-end support. With detailed documentation, developers can onboard quickly and efficiently, enhancing the payment experience for businesses and customers alike.

Simplifying Payments for All Industries

Whether you're in SaaS, B2B payments, remittances, or export, TransFi provides tailored solutions to meet your unique business needs. With global coverage, low fees, and an easy-to-use interface, businesses in traditional and digital sectors can streamline their financial operations and reach new heights.

Effortless Collections and Payouts

Collecting payments globally has never been easier. TransFi allows you to collect payments with just a few clicks, providing instant access to funds with minimal fees. From freelancers to large enterprises, the platform ensures timely payouts, fostering smooth financial relationships with employees, partners, and vendors worldwide.

Effortless Digital Asset Transactions Buying and selling digital assets globally has never been easier. TransFi's Ramp allows you to convert fiat and digital assets in just a few clicks, ensuring fast transactions with competitive rates. Supporting 50+ digital assets across 35+ blockchains and available in 100+ countries, our platform meets diverse investment needs.

With 200+ local payment methods, you can enjoy seamless transactions whether you’re an individual investor or a large enterprise. Our compliant Ramp Network simplifies the process with instant KYC verification, ensuring security and efficiency. Experience low processing fees and dedicated support, making your digital asset journey effortless.

Building the Future of Global Payments

In a world where businesses are increasingly transitioning to digital platforms, having the right global payment solution can make all the difference. TransFi is committed to helping businesses and individuals unlock new opportunities with its tech-first approach, ensuring real-time fund movement, low processing costs, and secure transactions.

For businesses looking to grow their international footprint or streamline their payment processes, TransFi is the global payment solution of choice. Experience the ease, security, and scalability that TransFi brings to the table, and take your business to the next level with seamless cross-border payments.

Contact TransFi Today

Ready to transform how you handle cross-border transactions? Get in touch with TransFi to explore the best solutions for your business and enjoy borderless payments with boundless potential.

By choosing TransFi as your global payment solution, you're opting for a secure, compliant, and innovative platform that understands the complexities of international finance—making cross-border payments simple and accessible for everyone.

0 notes

Text

PAYOUTS SERVICES IN INDIA FOR YOUR BUSINESS NEEDS - INDIA PAYOUTS

India Payouts is a payment API provider company in India that offers secure and reliable payout solutions for businesses. Their services are designed to streamline the payout process for businesses in various industries, including online gaming, forex trading, and others. They offer features like instant money transfer, real-time tracking, and robust security.

Here are some additional details you can include in your description, depending on what information is most relevant to your target audience:

Supported industries: India Payouts caters to a wide range of industries, but you can mention some of the specific industries they highlight on their website, such as online gaming, forex trading, etc.

Benefits for businesses: Focus on the benefits that India Payouts offers to businesses, such as streamlining payout processes, reducing costs, and improving efficiency.

Security features: Since security is a major concern for businesses that handle financial transactions, you can mention the specific security measures that India Payouts has in place to protect client information.

Ease of integration: If India Payouts offers an easy-to-integrate API, you can mention this as a benefit for businesses looking to quickly implement their payout solution.

Contact us or Visit to our website: https://www.indiapayouts.com/

#payment gateway for gambling in india#gaming payout api#payment gateway for gaming in india#payment gateway for games india#payout api provider in india#payment gateway for games in india#gambling payment gateway#gaming payouts api#gaming payouts api provider in india#payout service provider in india#payout api india#payout api provider india

1 note

·

View note

Text

Routefusion: Reliable Cross Border Vendor Payouts for Growing Enterprises

Routefusion provides reliable cross-border vendor payout solutions designed to streamline global payments for growing enterprises. With fast, secure transactions and support for multiple currencies, Routefusion’s platform simplifies complex international transfers, allowing businesses to expand smoothly. The API integration is easy to implement, offering transparency and cost-effective rates tailored to enterprise needs. By eliminating traditional banking barriers, Routefusion empowers companies to focus on scaling globally while ensuring timely payouts to vendors across borders, enhancing operational efficiency and financial management. Perfect for businesses looking to optimize their international payments, Routefusion is a trusted partner for global growth.

0 notes

Link

🚀 Payout API Integration 💻

Are you looking to integrate payout api to process and send funds seamlessly to vendors, employees, or customers? 💸

Check out our latest article: “How to integrate popular payout APIs like Haodapay, SabPaisa, Cashfree, IndiConnect, Open.money, and BulkPE.” 🌟

Don’t miss out! Start automating your payouts today. 💼💰

Read the full article here 👉 https://bit.ly/48lq3th

#PayoutAPI #PHP #haodapay #Cashfree #IndiConnect #SabPaisa #OpenMoney #BulkPE #Automation #WebDevelopment #Fintech #DevLife #Code

0 notes

Text

youtube

We have evolved from being a pure payment gateway to a converged payments solution, tackling the entire journey of payments and enabling businesses to have complete control over an automated flow of money.

With Razorpay’s end-to-end solution, you can now accept payments from customers, generate payouts to vendors or employees, automate FD & RTGS reconciliations, and schedule recurring payments to name a few.

What’s more? We make the collection of payments convenient by offering your customers the luxury of all payment modes including credit/debit cards, net banking, UPI, and wallets. With instant activation and easy integration, our API-driven automation is ready to elevate your business and help you outgrow the ordinary!

The Future of Payments is here!

#payment solution#payment route#payment transfer#payment processing#razorpay route#payement service#payments#recurring payments#business solution#business payment#business finance#money transfer#virtual accounts#banking#Youtube

1 note

·

View note

Text

UPI Payout API

Rainet Technology has introduced an innovative service known as the UPI Payout API Service, revolutionising how businesses handle transactions in India. The UPI Payout service leverages the Unified Payments Interface (UPI) system, which is renowned for its seamless, real-time payment capabilities. This service is designed to facilitate bulk disbursements, making it an ideal solution for businesses that need to manage mass payouts efficiently.

The UPI Payout API enables companies to integrate this powerful payment solution directly into their existing systems, allowing for the automated processing of transactions. This integration significantly reduces the time and effort required to manage large-scale payments, whether for vendor payments, employee salaries, or customer refunds. By using the UPI Payout API, businesses can ensure that their transactions are secure, fast, and reliable, thus enhancing their operational efficiency and customer satisfaction.

Rainet Technology's UPI Payout API service stands out due to its robustness and ease of integration. The API is designed to be user-friendly, providing comprehensive documentation and support to assist businesses in the integration process. Moreover, it supports various types of transactions, ensuring flexibility and adaptability to different business needs. With the UPI Payout API, businesses can benefit from the extensive reach of UPI, which is widely accepted across India, ensuring that transactions can be made to virtually any bank account in the country.

In summary, the UPI Payout API service by Rainet Technology offers a cutting-edge solution for businesses looking to streamline their payment processes. By integrating the UPI Payout API, companies can automate and expedite their financial transactions, leading to improved efficiency and customer experience. This service not only underscores Rainet Technology's commitment to innovation but also highlights the transformative potential of UPI in the digital payment landscape.

Visit Website: https://rainet.co.in/payin-and-payout.php

#payin#payin api#payout#payout account#cashfree payout#payouts api#payouts#instant payout#instant withdrawal#pay in pay out#bbps api provider#bbps login#paytm upi integration api#upi integration api#upi integration#upi api integration#bbps#education portal development company#upi payment gateway#upi payment gateway integration

0 notes

Text

How payment providers might expand options to increase profitability?

In the fast-evolving world of finance, payment providers face constant pressure to innovate and expand their offerings. As digital payments become increasingly ubiquitous, companies in the fintech space are tasked with not only meeting customer demands but also enhancing their profitability. Here, we explore several strategies payment providers can employ to expand options and drive revenue growth, incorporating key concepts like "Payout Solution" and "Fintech Software."

1. Diversifying Payment Methods

One of the most effective strategies for payment providers to increase profitability is to diversify the payment methods they offer. As consumer preferences evolve, businesses must adapt to include a wide array of payment options such as credit cards, debit cards, e-wallets, bank transfers, and even cryptocurrencies.

Implementing advanced Fintech Software can facilitate this diversification. By leveraging APIs and integration capabilities, payment providers can seamlessly incorporate various payment methods into their platforms. This not only enhances user experience but also captures a broader market segment. For instance, offering a comprehensive Payout Solution that accommodates both traditional and modern payment methods can attract businesses seeking flexible payment options for their customers.

2. Enhancing User Experience

A smooth and intuitive user experience is crucial for retaining customers and increasing transaction volume. Payment providers can invest in Fintech Software that prioritizes user experience, ensuring that interfaces are user-friendly and transactions are swift. Features like one-click payments, automated invoicing, and easy-to-navigate dashboards can significantly improve customer satisfaction.

Moreover, providing a seamless mobile experience is essential in today’s digital landscape. As more consumers engage in mobile commerce, optimizing payment solutions for mobile devices can enhance accessibility and drive higher transaction volumes. Payment providers can also use analytics tools to gather user data and personalize experiences, which can lead to increased loyalty and repeated transactions.

3. Offering Value-Added Services

To stand out in a crowded market, payment providers can develop and offer value-added services that complement their core offerings. These services could include fraud detection and prevention tools, chargeback management systems, and financial reporting features. By incorporating these elements into their Payout Solutions, providers can enhance the overall value proposition for businesses.

For instance, integrating advanced fraud detection algorithms powered by Fintech Software not only protects customers but also builds trust in the payment system. Similarly, providing businesses with detailed analytics and reporting tools can help them make informed decisions, thereby increasing their reliance on the payment provider's services.

4. Expanding Geographic Reach

As globalization continues to shape the economic landscape, expanding geographic reach presents a significant opportunity for payment providers. Entering new markets can diversify revenue streams and capture untapped customer bases. However, this strategy requires understanding local regulations, payment preferences, and consumer behavior.

Payment providers can utilize Fintech Software to facilitate international transactions and comply with regulatory requirements in different countries. This can include implementing multi-currency support, which can be a crucial part of an effective Payout Solution. Additionally, partnering with local financial institutions can ease market entry and build credibility within new regions.

5. Building Strategic Partnerships

Collaboration is a powerful tool for enhancing profitability. Payment providers can forge strategic partnerships with businesses in related sectors, such as e-commerce platforms, retail chains, and even fintech startups. By integrating payment solutions into these ecosystems, providers can tap into new customer bases and generate additional revenue.

For example, a payment provider could partner with an e-commerce platform to offer exclusive deals or discounts to customers using their payment solution. This not only incentivizes customers to use their service but also fosters loyalty. Additionally, leveraging Fintech Software to create easy integration points can facilitate these partnerships, making it simpler for businesses to adopt and promote the payment solutions.

6. Adopting Subscription Models

Another innovative approach for payment providers to increase profitability is to adopt subscription-based pricing models. By offering tiered subscription plans that provide different levels of service—such as transaction limits, advanced features, or enhanced customer support—providers can generate predictable revenue streams.

These subscription models can be particularly attractive to small and medium-sized businesses, which may prefer fixed costs over variable transaction fees. By incorporating features that cater specifically to these businesses into their Payout Solutions, payment providers can further solidify their market position.

Conclusion

The payment landscape is undergoing rapid transformation, and payment providers must continuously adapt to thrive. By diversifying payment methods, enhancing user experience, offering value-added services, expanding geographic reach, building strategic partnerships, and adopting subscription models, providers can not only meet evolving customer demands but also significantly boost their profitability.

Incorporating advanced Fintech Software is essential for executing these strategies effectively. By leveraging technology to create innovative Payout Solutions, payment providers can position themselves as leaders in the industry, ultimately leading to sustainable growth and increased revenue. As the market continues to evolve, those who embrace change and prioritize customer-centric approaches will emerge as the most successful players in the fintech space.

0 notes

Text

Breakpoint 2024 Solana GameShift On Google Cloud Web3

Solana Breakpoint 2024

Solana GameShift

We are thrilled to inform how Google Cloud, through its partnership with Solana Labs, is influencing the future of gaming as it join the vibrant community at Solana Breakpoint this week.

The core of its collaboration is GameShift, which offers all of the Web3 primitives and actions that games need, including wallets, tokenized assets, and on-chain markets. As of right now, Gameshift’s products are accessible via the Google Cloud Marketplace.

The promise of Web3 in games, how GameShift can assist developers in realizing this potential, the security of utilizing Solana GameShift for Web3, and the current smooth integration between GameShift and Google Cloud with the Google Cloud community.

Google Cloud has been aware of Web3 technologies’ potential for a while now. Its Web3 BigQuery datasets, Blockchain Node Engine product, and Web3 for Startups initiative are some of the ways it supports this ecosystem.

The evolution of gaming on Web3

Games may now reach players through a new channel with an enhanced value proposition thanks to Web3. Games can effortlessly transform their players from clients into collaborators and co-creators with Web3. This is significant because players are becoming more and more aware of how they add value to games and earn money from them.

Through the process of “composability,” or the simplification of interactions between on-chain programs from various suppliers, blockchains facilitate innovative experiences and developer efficiencies. Composability significantly lowers the cost and complexity of delivering real-money gaming services, generating interest on stored value balances, and giving players a choice in payment options and payout schedules in the payments domain. Additionally, compositability makes it possible to include cutting-edge Web3 game development features like global player reputation systems, open modding, and guild management.

Web3 for gaming is simplified with GameShift

Developers of video games can start using Solana GameShift API-first approach without needing any prior blockchain knowledge. The general manager of GameShift, Davis Hart, stated, “Our goal in building Solana GameShift is to leverage the unique capabilities of Web3 and provide a development and player experience as similar to existing services as possible.”

Principal Benefits

With its developer-friendly REST API, Solana GameShift offers every feature related to Web3 gaming. The Solana Labs team provides GameShift clients with growth support, assistance in creating Web3 gaming strategy, and deep access to the Solana ecosystem. This implies that studios may use GameShift with confidence, knowing that it will expand along with them over time, and that they won’t require numerous providers or expert blockchain developers.

GameShift now provides five essential features:

Wallet integration done well

Build wallets right into your game or help users who already have Solana wallets. Players may have a seamless, safe experience with GameShift wallets since they abstract key storage and offer a clear, user-friendly transaction signing flow without forcing them to exit your game environment. Because its wallets are non-custodial, games do not have to keep track of user asset pools.

Game asset management

With specific asset qualities, rarity, and in-game functionality, creating and managing in-game assets on the Solana blockchain is simple. Additionally, it manages asset transfers, which simplifies the implementation of features like gifting and trading in your game economy.

Pay-in and pay-out systems

Use safe, affordable transactions for rewards, subscriptions, and in-game purchases. This API manages transaction processing and currency conversion behind the scenes, supporting payments with both fiat and cryptocurrency. It also makes withdrawals simple, enabling users to return in-game assets to their bank accounts or personal wallets.

Marketplace functionality

Establish and maintain in-game markets with ease, allowing users to exchange, buy, and sell their assets. By managing listings, bids, transactions, and transfers, this API makes sure that the market is safe and effective. Additionally, it offers royalties implementation tools that let you profit from secondary sales even on user-generated material.

Reward schemes

Create and put into place complex reward schemes utilizing blockchain technology. With the help of this API, you can develop achievement- or token-based loyalty programs that give players real benefits. It uses custom logic to manage program enrollment, tracking, and prize distribution, giving you creative ways to encourage player involvement and retention.

Lowering Web3’s hazards in gaming

“Given the history of hacks and scams in Web3, developers are rightfully concerned about player safety,” stated Hart. But these issues can be raised to the level that developers regularly address in their off-chain systems with the help of game designers and appropriate security protocols.

The secret to GameShift’s approach is its non-custodial, invisible wallet architecture. With the use of distinct user wallets, each secured by unique cryptographic keys, this feature allows users to separate their assets from one another and lowers the possibility that an attacker may access all of the users’ assets at once. The hazards connected with user-managed keys and seed phrases are eliminated when key management is abstracted away from the user.

Because the game controls when and what kinds of transactions are exposed to the user, users who utilize Solana GameShift wallets are much more protected from scammers. Transaction approval flows notify the user of any changes to their balance and mimic the impact of any on-chain activity. Only on-chain services from verified and reliable vendors are used by GameShift. These tactics stop third parties from using hacks or phishing attacks to cheat users of their assets.

Using Web3 and Google Cloud

Developers may now easily enable Web3 within their current Cloud game backend services by deploying Solana GameShift on the Google Cloud Marketplace.

What can be achieved using GameShift on Google Cloud is hinted at by this reference architecture, which includes:

Integrating GameShift transactions with already-existing player data in BigQuery to produce a more comprehensive picture of player behavior.

Using the Solana public BigQuery dataset, BigQuery and Vertex AI are being used to analyze player behavior on-chain.

Easily host user-generated content worldwide using cloud storage.

generative AI is being used to game assets and user-generated material to guarantee adherence to content policies, toxicity, content moderation, anti-cheat measures, player privacy, safety, and security.

In order to quickly consume real-time blockchain event data and start in-game activities, use Pub/Sub.

Breakpoint Solana 2024

Web3 gaming has a bright future ahead of it, and looking forward to further developments:

Solana Mobile

The upcoming web3 mobile gadget, which was unveiled at Breakpoint 2024, will provide a new platform for mobile Web3 gaming.

Solana Permissioned Environments

By integrating Solana Permissioned Environments with GameShift on Google Cloud, studios may take advantage of the Solana ecosystem while still having control over their chain access.

Tournament administration

To make the integration of fiat and Web3 payments for gaming tournaments easier, GameShift recently announced the release of a real-money tournament administration tool.

In order to enable game creators to produce the next wave of captivating, safe, and inventive gaming experiences, Google Cloud and Solana GameShift are dedicated to providing them with the resources and infrastructure they require. With the support of GameShift and its partnership with Solana Labs, Google Cloud is assisting in realizing the potential of Web3 gaming.

Read more on Govindhtech.com

#SolanaGameShift#GameShift#GoogleCloud#CloudWeb3#Breakpoint2024#games#BigQuery#blockchain#news#technews#technology#technologynews#technologytrends#govindhtech

0 notes

Text

Easebuzz API Integration by Infinity Webinfo Pvt. Ltd.: A Streamlined Payment Gateway Solution

In today’s fast-paced digital economy, businesses must integrate efficient and reliable payment solutions to ensure seamless financial transactions. Easebuzz, a leading payment gateway platform, offers an array of features that streamline the payment process for enterprises and consumers alike. With an array of customizable options, Easebuzz ensures that businesses can securely handle various payment methods, enabling a smooth transaction experience.

One of the firms excelling in this integration is Infinity Webinfo Pvt. Ltd., a renowned IT service provider specializing in software solutions and website development. By partnering with Easebuzz, Infinity Webinfo Pvt Ltd ensures that its clients can easily implement robust and secure payment systems into their existing digital platforms.

Easebuzz API Integration by Infinity Webinfo Pvt. Ltd.

Easebuzz

Easebuzz is an Indian-based fintech company that offers a wide range of digital payment solutions designed to simplify online financial transactions for businesses. Catering primarily to small and medium enterprises (SMEs), Easebuzz provides an easy-to-use platform that enables businesses to manage their payments securely and efficiently. Here's a detailed breakdown of what Easebuzz offers and how it benefits businesses

Key Features of Easebuzz

Multiple Payment Options Easebuzz supports various payment methods, including:

Credit Cards

Debit Cards

UPI (Unified Payments Interface)

Net Banking

Mobile Wallets (Paytm, Google Pay, etc.)

Simple and Efficient API Integration Easebuzz provides well-documented APIs that enable businesses to easily integrate their payment gateway into websites, mobile apps, and other platforms. This allows for seamless payments, subscription management, and automated invoicing.

Subscription-Based Payment Models Easebuzz supports subscription billing, which is especially beneficial for businesses offering subscription services (e.g., SaaS platforms, streaming services, etc.). This feature automates recurring payments and reduces the manual effort involved in tracking renewals and invoices.

Security and Compliance Easebuzz ensures high levels of security with PCI-DSS (Payment Card Industry Data Security Standard) compliance and end-to-end encryption, ensuring that all transactions are secure. This includes safeguarding sensitive information like card details and personal data.

Automated Invoicing Easebuzz’s system allows businesses to generate automated invoices once payments are processed, streamlining the accounting process and reducing manual labor. This is especially useful for businesses dealing with a high volume of transactions.

Split Payments Easebuzz offers split payment functionality, allowing payments to be divided among multiple parties, which is crucial for businesses operating marketplaces, platforms with multiple vendors, or collaborative ventures.

Real-Time Analytics and Reporting Through its dashboard, Easebuzz provides businesses with real-time insights and reports on their transactions. This helps businesses track their sales, monitor transaction trends, and make data-driven decisions to improve their payment processes.

Easebuzz Services

Payment Gateway Easebuzz offers a core payment gateway solution that provides secure and reliable transaction handling. This gateway is equipped with the latest encryption protocols to ensure data security and helps businesses manage both domestic and international payments.

Payouts Easebuzz facilitates quick payouts for businesses, allowing them to transfer funds to employees, suppliers, or other stakeholders through its Payout service. It supports instant transfers via IMPS, NEFT, and RTGS.

Smart Links Easebuzz Smart Links allow businesses to create unique payment links that can be shared via email, SMS, or social media platforms. This makes it easy for businesses to collect payments without needing a dedicated website or app.

Subscription Management Easebuzz allows businesses to create, manage, and automate recurring billing processes with ease. This feature is beneficial for companies that operate on a subscription model, such as SaaS providers or content subscription platforms.

Vendor and Marketplace Management For businesses that operate in a marketplace environment, Easebuzz offers features like vendor management and split payments, helping automate complex financial transactions between multiple parties.

GST Invoicing and Compliance Easebuzz helps businesses comply with Indian tax regulations by offering built-in GST invoicing functionality. This allows businesses to manage their tax liabilities more effectively and automate tax calculations on invoices.

Industries That Benefit from Easebuzz

E-commerce: Easebuzz enables e-commerce platforms to accept a variety of payment methods, supporting faster checkouts and improved customer satisfaction.

Travel: Many travel portal use Easebuzz to booking and online payment for flight, rail, hotel, and many other services.

Education: Many educational institutions use Easebuzz to manage online payments for tuition fees, event registrations, and other charges.

Healthcare: Hospitals and clinics can use Easebuzz to process patient payments for medical services, making the payment process faster and more convenient.

SaaS Providers: SaaS companies can leverage Easebuzz’s subscription management features to automate billing cycles and provide customers with a seamless experience.

Nonprofits: NGOs and nonprofits can use Easebuzz’s payment gateway and Smart Links to collect donations efficiently and securely.

API Integration with Infinity Webinfo Pvt. Ltd.

Infinity Webinfo Pvt. Ltd. is a highly skilled IT development company known for its custom API integration services. The collaboration with Easebuzz allows Infinity Webinfo to offer end-to-end solutions for payment gateway integration. Here's how Infinity Webinfo leverages Easebuzz API integration to benefit businesses:

1. Simplified Payment Gateway Setup

With Easebuzz’s well-documented API, Infinity Webinfo provides easy-to-implement solutions for integrating payment gateways into websites, apps, and other digital platforms. The seamless integration ensures quick go-live for businesses, reducing the time to market and enabling them to accept payments instantly.

2. Customization and Flexibility

The Easebuzz API allows Infinity Webinfo to customize the payment experience for their clients. Whether it's altering the payment flow, branding the gateway as per the business, or ensuring region-specific payment options, Infinity Webinfo configures everything to suit the unique needs of each business.

3. Comprehensive Payment Solutions

Infinity Webinfo’s integration of Easebuzz extends beyond basic payments. They incorporate advanced features such as:

Subscription Payments: For businesses offering subscription-based services.

Split Payments: Useful for marketplace platforms where payments need to be divided among multiple stakeholders.

Invoice Generation: Automated invoice generation post-payment to streamline accounting.

4. Security and Compliance

By using the latest encryption technologies, Infinity Webinfo ensures that all transactions processed through Easebuzz are secure and compliant with global standards. This not only provides peace of mind for the business but also assures customers of safe and secure transactions.

Benefits of Integrating Easebuzz with Infinity Webinfo Pvt. Ltd.

1. Increased Conversion Rates

With the integration of multiple payment methods and a user-friendly interface, businesses can reduce cart abandonment and increase conversion rates. Infinity Webinfo’s expertise ensures a smooth checkout process, which leads to higher customer satisfaction and retention.

2. Real-Time Reporting and Analytics

Infinity Webinfo Pvt Ltd’s integration service provides businesses with access to detailed real-time reports via Easebuzz’s dashboard. This helps in monitoring transaction trends, optimizing payment workflows, and generating actionable insights for business growth.

3. 24/7 Technical Support

Businesses integrated with Easebuzz through Infinity Webinfo Pvt Ltd benefit from round-the-clock technical support. This ensures any issues related to payment processing are resolved swiftly, minimizing downtime and maintaining operational efficiency.

Conclusion

For businesses looking to enhance their payment processes, the Easebuzz API integration with Infinity Webinfo Pvt. Ltd. provides a comprehensive solution. The collaboration offers a highly customizable, secure, and efficient payment gateway integration service tailored to meet the unique needs of businesses. By streamlining payments and improving user experience, Infinity Webinfo helps businesses focus on growth while leaving the technical complexities of payment handling in capable hands.

In an era where digital payments are crucial for success, partnering with Infinity Webinfo Pvt. Ltd. for Easebuzz API integration ensures a reliable and future-proof solution.

For more details contact us now: - +91 9711090237

#easebuzz API Integration#Easebuzz#payment gateway api integration#payment gateway integration#Payment gateway#API Integration#infinity webinfo pvt ltd

0 notes